Retirement Plans

|

Would you like to learn more? Request a Call |

Helping You Get One Step Closer to Retirement

How confident are you about having a comfortable retirement? If you are a little worried, you’re not alone. We can help.

Participating in your employer’s 403(b) or 457(b) plan can take you one step closer to a retirement that can support your lifestyle.

Visit our Frequently Asked Questions

A 403(b) plan is a retirement savings plan for employees of public schools, non-profits and certain churches. This is a retirement plan in addition to any type of pension your employer may offer. With a traditional 403(b) plan your contributions are tax-deferred, meaning you pay taxes on the money when you take it out of the plan. With a Roth 403(b) plan you pay taxes on the contributions up front, but the money grows tax-free.

For your state's Retirement System calculation and more details, please visit:

A 457(b) Plan is a supplemental retirement plan for governmental and certain non-governmental employers. This type of plan is tax-deferred, which means you pay taxes on the money when you take it out of the account. A 457(b) plan has many flexible features that allow you to save on a tax-deferred basis while still having access to your money through loans, and unforeseen emergency distributions if the need arises.

If your employer offers both a 403(b) plan and a 457(b) plan you can maximize your retirement savings by contributing the maximum allowed to both plans.

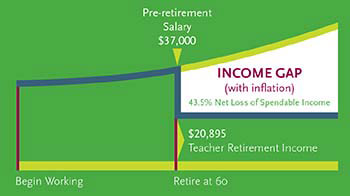

When you take the time to plan for your financial future, retirement can provide an opportunity to do what you have always wanted to do. Without proper planning, retirement could mean working during your golden years, cutting back on your lifestyle and even relying on family members to help take care of you. Beware of the retirement income gap.

Assumptions for Gap Analysis—(Source is TRAK Software by Trustbuilders) Teacher’s Pre-retirement salary is $37,000, teacher retires at age 60 and receives $20,895 in TRS Pension benefit, based upon Texas TRS guidelines.

Will your retirement income cover increasing retirement expenses? Many school district employees will experience a significant drop in income when they retire, even though they may be covered under a pension plan.1 Chances are a state pension is not enough.

- The Retirement Analysis Kit (TRAK) Software by Trustbuilders, Inc. 2012 Version.

You can take control of your retirement security by contributing to your 403(b) savings plan through payroll deductions. Your 403(b) plan allows you to accumulate savings on a highly tax-favored basis, to supplement your state teacher retirement pension plan or other retirement plans.

Your retirement savings can move with you through the years and can be transferred to other employer plans or into a traditional IRA.

One of the greatest advantages of participating in a tax-deferred plan is that all dividends, interest, capital gains and growth potential accumulate on a tax-deferred basis while the money remains in the account. Only when you begin receiving the money will you have to pay income tax on it.

Save more without seeing a difference in your take-home Pay:

| Post-Tax | Pre-Tax | |

|---|---|---|

| Monthly Gross Income | $4,500 | $4,500 |

| Pre-Tax Contributions | $0 | $133 |

| Standard Tax Deductions | $672 | $639 |

| Post-tax retirement contributions | $100 | $0 |

| Take-home Pay | $3,113 | $3,113 |

(This hypothetical example is based on a teacher in the state of Texas claiming single and zero allowances and in the 25% tax bracket.)

When time is on your side, every increase you make to your retirement savings can make a significant impact on the total amount of money you have to live the life you want in retirement.

*Guarantees are based upon the claims paying ability of the issuing company.